Business Loan in Singapore | Fast, Flexible Funding

Need funds to grow your business fast? A business loan in Singapore can help you bridge financial gaps, manage cash flow, or expand operations — without disrupting your daily business. Whether you run a small startup or a growing SME, 1-Money makes it easy to apply and get approved quickly.

(99% loan approval rate)*

What Is a Business Loan?

A business loan gives your company access to working capital right when you need it most — helping you manage operations, grow your business, or handle unexpected expenses. At 1-Money, our SME loans in Singapore are designed for speed and flexibility, so you can stay focused on running your business.

Here are four common reasons why businesses apply for a business loan in Singapore:

Cash Flow Support

Many SMEs experience seasonal fluctuations. A business loan for an SME helps maintain operations during slower months.

Expansion Costs

Need to open a new outlet or upgrade equipment? A Singapore business loan provides the funds to grow without cash strain.

Marketing and Inventory

Boost your marketing reach or stock up for festive demand with an SME loan in Singapore.

Unexpected Expenses

When sudden costs hit, SME business loans in Singapore provide timely support to keep your business running smoothly.

Why Choose 1-Money’s Business Loans?

1-Money is a licensed moneylender under Singapore’s Ministry of Law, providing responsible and transparent lending solutions tailored to SMEs.

What makes us different:

Fast approval and funding turnaround

No hidden fees or unclear terms

Personalised loan options based on your business needs

Trusted by SMEs across Singapore

Who Can Apply for a Business Loan?

Before applying, make sure your business meets these simple requirements:

ACRA Registered

Your business must be officially registered with the Accounting and Corporate Regulatory Authority (ACRA) to confirm legitimacy and allow lenders to verify its background.

At Least 12 Months in Operation

Lenders prefer businesses with at least one year of operation to demonstrate stability and consistency.

Local Director/Shareholder

At least one director or shareholder must be a Singaporean, Singapore PR, or a foreigner residing in Singapore for accountability and smoother verification.

How Much Can I Borrow for My Business Loan?

Borrow from $5,000 up to $300,000, depending on your business profile and repayment capacity. Your approved loan amount will be based on your revenue, cash flow, and existing financial commitments.

| Loan Amount | Best For |

|---|---|

| $5,000 – $20,000 | Short-term expenses, supplier payments, or emergency needs |

| $20,000 – $50,000 | Small renovations, hiring, or marketing efforts |

| $50,000 – $100,000 | Equipment purchases, vehicles, or operational upgrades |

| $100,000 – $300,000 | Business expansion, bulk inventory, or project launches |

What Are the Required Documents for a Business Loan?

Having these documents ready not only streamlines your business loan application process but also helps you receive a faster response from licensed moneylenders in Singapore. If any documents are missing or incomplete, it may delay the approval of your SME business loan application in Singapore.

Below is a checklist of what you’ll need when applying for SME loans in Singapore:

Company’s BizFile from ACRA

Singapore’s ACRA issues the BizFile document, an official record that verifies a company’s formal recognition and legal establishment, including its ownership, address, and primary activities.

Company’s Latest 6 Months’ Bank Statements

Bank statements help lenders assess your business’s cash flow, repayment capacity, income, expenses, and financial stability.

NRIC Copies of All Directors and Shareholders

Providing NRIC copies for all key stakeholders ensures transparency and compliance with local lending regulations.

Notice of Assessment (NOA) for All Directors and Shareholders

The NOA details annual income declared to IRAS, helping lenders gauge the financial health of the people managing the company.

CBS and MLCB Reports for All Directors and Shareholders

Credit Bureau Singapore (CBS) and Moneylenders Credit Bureau (MLCB) reports detail credit history; a strong record boosts approval chances and influences loan terms offered.

Tenancy Agreement

Verifies your company’s place of business or operating address, demonstrating a stable, ongoing presence in Singapore for loan approvals.

What Our Customers Say

Our clients trust 1-Money for our professional service, fast approvals, and transparent terms.

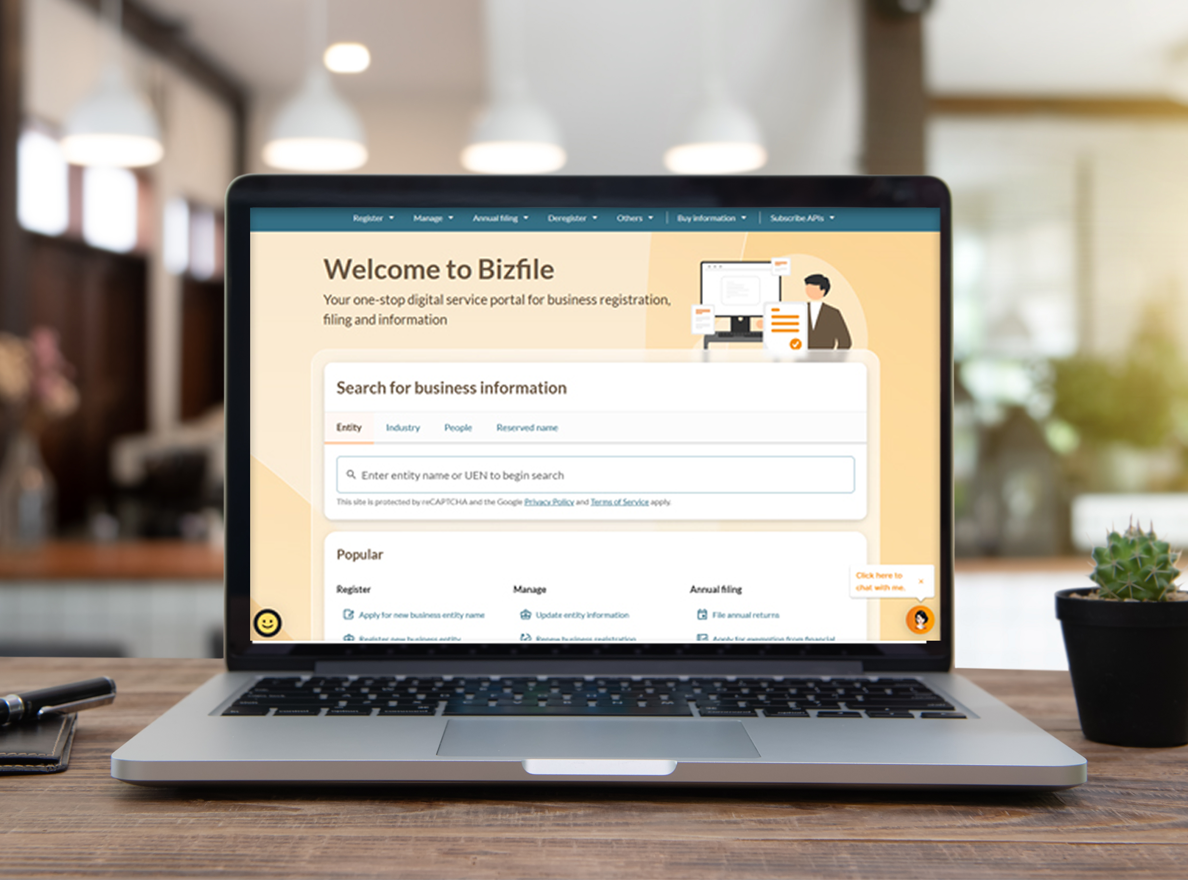

3 Steps to Apply for a Business Loan

Submit Your Application

Apply online via our website or walk in with the necessary documents.

Verification & Discussion

Visit our office for face-to-face verification and discuss your SME loan terms and requirements.

Finalise & Receive Funds

Finalise and Receive Funds

Once approved, sign the loan contract and receive your funds via cash or bank transfer.

FAQs for Business Loans in Singapore

How fast can I receive my business loan?

Once approved, you can receive the funds immediately after signing your loan contract.

What is the interest rate for your business loans?

At 1-Money, our business loan interest rates are 4% to 8% per month.

Do business loans require collateral?

In general, collateral refers to an asset — such as real estate, equipment, or inventory — that a business offers to a lender as security for a loan. Suppose the borrower fails to repay their loan despite repeated reminders and debt collection attempts. In that case, the lender can legally seize the collateral in a bid to recoup the outstanding amount owed.

That being said, with 1-Money’s unsecured business loans, there’s no need to provide any form of collateral. This makes the application process much faster and more accessible, especially for small and medium-sized enterprises (SMEs) that may not have substantial physical assets.

How can I improve my chances of getting approved for a business loan?

Maintain a good credit score, provide accurate documents, and ensure your company’s financials are stable.

What is the repayment period?

We offer instalment plans of up to 24 months, subject to approval and depending on the loan amount requested.

What types of repayment plans are available?

At 1-Money, you’ll be able to choose between flexible weekly or monthly repayment plans to suit your business’s cash flow.

Are there any penalties for early repayment?

No. We do not impose early repayment penalties for our business loans.

How can I select the best moneylender for a business loan in Singapore?

When selecting a licensed moneylender for a business loan in Singapore, it’s vital to evaluate credibility, transparency, and service quality. Look for these key factors:

Valid licence under MinLaw

Always confirm that the lender is officially licensed under Singapore’s Ministry of Law. This ensures they operate legally and comply with strict lending regulations that protect borrowers’ rights.

Transparent interest rates

A trustworthy lender will clearly communicate all interest rates, fees, and repayment terms upfront, without any hidden charges. Transparency helps you make informed financial decisions.

Positive customer reviews — read verified 1-Money reviews

Real customer experiences offer valuable insights into service quality, reliability, and professionalism. Reading verified 1-Money reviews can help you understand how we’ve supported other business owners.

Flexible loan options

Every business has different financial needs. Select a lender that offers a range of SME business loans in Singapore and repayment plans that align with your cash flow.

Responsive customer service

Fast, helpful support makes a big difference, especially for urgent business funding needs. A good lender responds promptly to your queries and guides you throughout the loan process.

How can I find out more about 1-Money’s business loans?

You may contact us by phone, WhatsApp, or visit our office — full details are available on our Contact page. Our team will do our best to respond within minutes during business hours.

Are licensed moneylenders open on Sundays in Singapore?

Not all licensed moneylenders in Singapore are open on Sundays — but 1-Money is! We’re open every Sunday, 11 am – 4:30 pm, ready to assist with urgent business loan applications.

Your business deserves to grow — quickly.

Get a Singapore business loan approved in hours.

*Subject to terms and conditions