Licensed Moneylender and Legal Loan Company in Bugis, Singapore

Hello! Welcome to 1 – Money – Your Reliable Private Moneylender in Singapore!

Our loan company is always ready to help with your private, legal loan needs. Our moneylender loans are competitive, super quick, highly accessible, 100% customisable and transparent — no hidden fees and charges!

We’re a Licensed Moneylender You Can Rely On, Always

Founded in 2009, 1 – Money is a licensed moneylender you can count on to provide swift legal loans regardless of your nationality and income level. As an authorised, legal moneylender in Singapore, we are stringently regulated by the Ministry of Law’s Registry of Moneylenders.

Borrowing from private moneylenders like 1 – Money is a safe alternative if you find yourself in need of a quick legal loan in Singapore. For one, we do not discriminate against borrowers with lower credit scores or lower salaries. Our interest rates, fees and charges are absolutely transparent and regulated, too!

Why Trust 1 - Money as

Your Legal Moneylender in Singapore?

99% loan approval

Enjoy speedy legal loan approval so long as your Loan Information Report is unmarred

Competitive interest rate

3.92% monthly

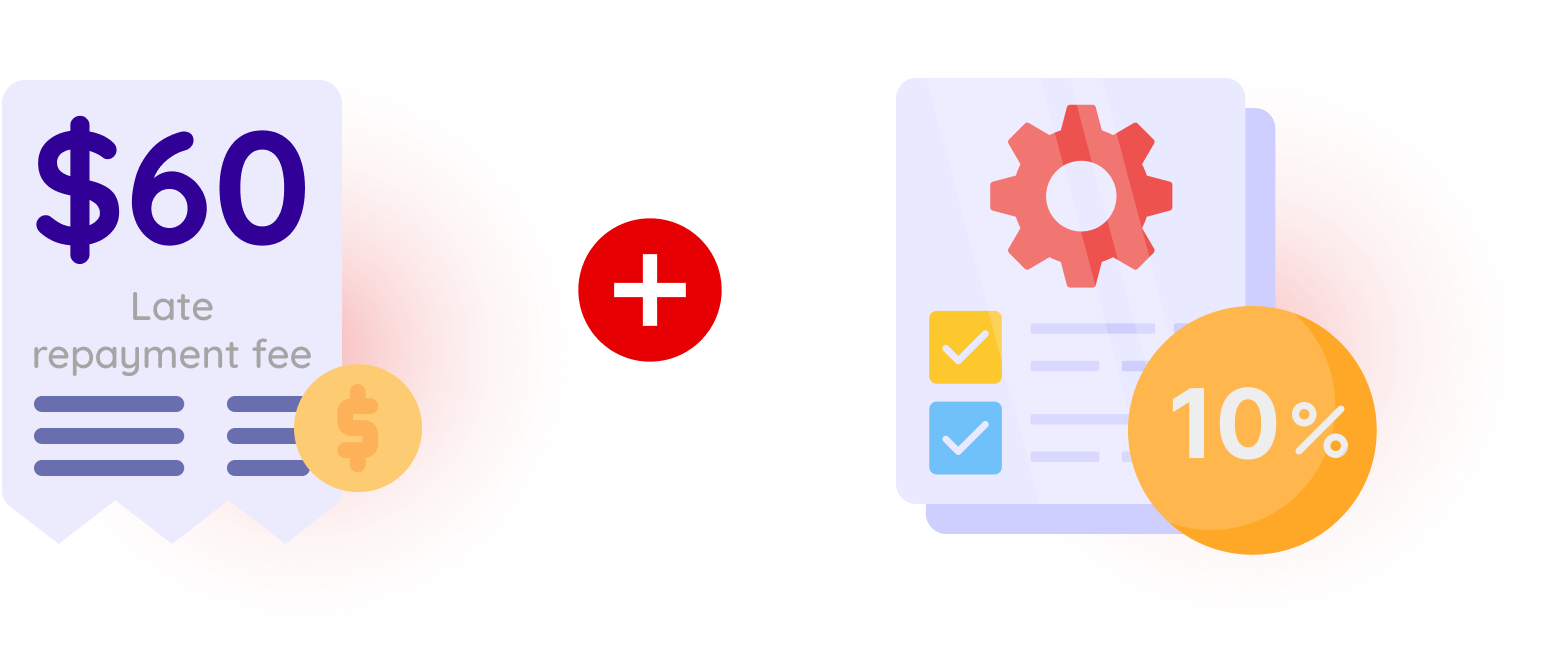

Transparent fees and charges

$60 late repayment fee, 10% loan admin fee

Up to 24 months loan instalment plan

We are happy to discuss; most licensed moneylenders in Singapore only offer up to 12 months tenure

Flexible monthly and weekly repayment plans

Pick a repayment plan that suits your financial needs

Friendly yet professional service

Our customers value our friendly, patient, honest, problem-solving services

All nationalities can apply

Our private loans are open to Singaporeans, PRs, and foreigners

Established legal loan company in Singapore

16 years of licensed moneylending experience and counting since 2009

We offer the human touch

Empathy is in our DNA; we go the extra mile to ensure all customers feel thoroughly understood and supported at every point of their loan journey

Get Up to 6X Your Monthly Salary with a Licensed Moneylender

No matter how much you earn, borrow up to a maximum of 6X your monthly salary with us.

Here’s a quick look at the moneylender loan amount you may borrow from 1 – Money:

| Your annual income | Singaporeans / Singapore PRs | Foreigners |

|---|---|---|

| Under $10,000 | $3,000 | $500 |

| $10,000 to $19,999 | $3,000 | $3,000 |

| $20,000 and above | 6X monthly salary | 6X monthly salary |

Easy Moneylender Loan Eligibility

- 18 years old and above

- Employed full-time or part-time

- Singaporean/ PR/ Foreigner

Simple Documents Required

- NRIC (or Work Pass for foreigners)

- Latest 3 months’ payslips

- IRAS Notice of Assessment or CPF statements

- Residential proof for foreigners (e.g. tenancy agreement, phone bill, utility bill)

Quick & Easy Legal Loan Application Process

- Submit your moneylender loan application online

- Visit our office for in-person interview with all supporting documents

- Review and sign the legal loan contract

- Get your private loan in cash or via PayNow instantly

Need an urgent legal loan?

Apply with 1 – Money right away. We’ll get you the loan you need.

Perks of Borrowing From Private Licensed Moneylenders

#1 Simple, quick loan process

A top-rated authorised moneylender in Singapore like 1 – Money understands your need for speedy funds. And that’s precisely why we’ve made the loan process easy and hassle-free.

As a modern online moneylender in Singapore, we highly recommend you submit your loan application on our website to kickstart your loan process. The cherry on top? You can submit your online loan application anytime, anywhere — 1 – Money is your go-to 24 hours moneylender in Singapore with functional online loan application forms. Thereafter, you’ll need to visit our office with all supporting and identity documents before you can get the cash.

#2 Same-day loan approval and disbursement available

1 – Money strives to respond to customers’ queries and online loan applications as quickly as possible, typically within a few minutes during business hours. To that, you can even enjoy same-day loan approval and cash disbursement once you’ve reviewed and signed on the loan contract in-person.

For urgent cash needs, feel free to visit 1 – Money’s office during business hours with all your supporting documents. We’ll make sure to get your legal loan needs sorted in no time.

#3 No minimum income requirement

One of the best parts of borrowing from moneylenders is that there’s literally no minimum income requirement in place. How much you can borrow depends on how much you earn, period.

#4 Open to borrowers with low credit scores

Yes, you read that right. Borrowers with low credit scores can obtain a loan from private moneylenders like 1 – Money so long as a quick review of your Loan Information Report all checks out with nothing jarring to note.

#5 No risk of losing assets

1 – Money only offers unsecured loans. This means you can get a loan without having to pledge any asset or collateral; there’s zero risk of losing any of your prized assets!

#6 Fee and interest rate limits

As a reputable loan company in Singapore, we take pride in operating in strict compliance with the law. And that is why our interest rate, penalty late interest rate, loan admin fee and late payment penalty fee are always capped, and under legal ceilings.

#7 No hidden fees and charges

1 – Money is a legal moneylender that only does legitimate moneylending businesses — no shady, questionable fees and interest rates involved. Our fees and charges are all unambiguous, and clearly explained.

#8 Fully customised loan solution

We’re a legal moneylender that genuinely wants to help, regardless of your financial situation. Help us to understand your needs better by speaking to our friendly loan officers. We will craft a fully customised loan solution just for you.

#9 Thorough explanation of loan contract T&Cs

We’ll never want you to commit to a loan without first understanding what you are signing up for. Count on us to give you the full dibs on your loan contract terms and conditions, no matter if you’re a new or returning customer of ours. We are a trusted moneylender in Singapore after all.

#10 Protection by the law

Did you know you are protected by the law when you deal with a licensed moneylender in Singapore?

You have the right to lodge complaints against moneylenders if they’ve flouted the rules (e.g. overcharging you in terms of interest rates and other fees, using abusive behaviour or language, intimidating you, granting you a loan without first doing any due diligence on their part, coercing you to sign off on the loan contract without thoroughly explaining all loan terms, harassing you for payment, etc).

The Registry of Moneylenders will investigate carefully. All offending moneylenders will be dealt with accordingly.

Keen to learn more about 1 - Money’s moneylender loan? Reach out anytime. We’re happy to share more.

Why We Are the Trusted Go-To Moneylender in Singapore for Legal Loans

Frequently Asked Questions: Licensed Moneylenders &

1 - Money’s Loans

What are licensed moneylenders in Singapore?

Licensed moneylenders are registered loan providers that have been authorised by the Registry of Moneylenders to conduct the business of legal moneylending in Singapore. All licensed moneylenders have stringent rules and regulations to follow, and failure to comply may result in fines and/or the suspension of their licences.

Are licensed moneylenders trustworthy?

Licensed moneylenders found in the Registry of Moneylender’s official list of licensed lenders should all be trusted loan providers.

All loans offered by licensed moneylenders are legal in nature, and are bound by the loan agreement in black and white. They offer a safe alternative to borrowers looking for speedy loans, and have nothing to do with loan sharks or unlicensed moneylenders.

With that being said, it is best to still do your research, read up on moneylenders’ reviews, and get word-of-mouth recommendations from people you know if possible.

Are licensed moneylenders transparent?

While we cannot speak for all licensed moneylenders in this regard, 1 – Money prides ourselves on treating our customers with dignity and respect at all times. This extends to all our loan packages — there are no hidden fees, charges, or dubious interest rate hikes. Everything is written and communicated clearly to our customers before any loan is a sealed deal. To protect yourself, read our guide on licensed moneylenders’ interest rates and how they are calculated.

Do all licensed moneylenders offer secured loans?

No, some legal moneylenders do and some don’t. Case in point, we only provide unsecured loans at our loan company.

Are loan approval rates high at licensed moneylenders’?

Yes, loan approval rates are generally pretty high, with many licensed moneylenders proudly advertising approval rates anywhere from 90% to 99%.

How can borrowers improve their chances of being approved for legal loans by a licensed moneylender in Singapore?

It’s easy to get loan approvals at our loan company — borrowers simply have to maintain a good credit score, show proof of stable income, and provide accurate and complete information.

Do licensed moneylenders in Singapore discriminate against borrowers?

No, you’ll be happy to know licensed moneylenders in Singapore are very inclusive, and they don’t discriminate against borrowers in any way.

Can low-income earners borrow from legal moneylenders in Singapore?

Yes! Low-income earners can apply for loans from legal moneylenders in Singapore without being judged. That being said, the approved loan sum is lower for low-income earners since it’s tagged to their salary.

Do trusted, legal moneylenders in Singapore provide loans to discharged bankrupts?

While the same cannot be said for all licensed moneylenders, 1 – Money does provide loans to discharged bankrupts so long as they are employed and are eligible to borrow, in accordance with their Loan Information Report at the Moneylenders Credit Bureau.

Can the unemployed obtain loans from a reliable private moneylender in Singapore?

Some private moneylenders offer loans to the unemployed who can prove they have consistent sources of alternative income (e.g. annuity payouts, alimony, investment dividends, etc.), while some private moneylenders don’t. To borrow from 1 – Money, borrowers must be gainfully employed. Borrowers can be employed full-time or part-time. Gig workers, freelancers, and the self-employed can all qualify for loans from us.

Can foreigners borrow from licensed moneylenders in Singapore?

Yes, foreigners can borrow legally from licensed moneylenders in Singapore if they are employed, have a steady income stream, have a valid Work Pass (usually S-Pass, E-Pass), and can furnish all of the required documents. Contact us to find out all the necessary documents you need to prepare.

What are the top reasons why people like borrowing from legal moneylenders?

The top reasons are that licensed moneylenders have extremely short turnaround times, and very easy eligibility criteria. For instance, if all required documents are in order, we can process your application, approve and disburse your loan within an hour. What’s more, we do not impose any minimum income requirements.

What’s the loan repayment period for licensed moneylenders?

Most legal moneylenders offer loan repayment periods of up to 12 months. Here at 1 – Money, we are happy to negotiate, and may provide up to 24 months for your loan repayment plan should you require more time to pay off your loan.

What are the licensed moneylender fees at 1 - Money?

We charge a $60 late repayment fee per month when repayment is late and a 10% loan processing fee at the point at which the loan is granted. If there’s a need to recover the loan legally and the moneylender is successful at making the claim, the borrower will be liable for the legal costs as ordered by the court.

What’s the moneylender late interest rate at 1 - Money?

We’re a legal moneylender in Singapore that strictly follows the rules and regulations set by the Registry of Moneylenders. Our late interest rate — and regular interest rate — stands at 3.92% per month, below the 4% per month ceiling legally allowed for all legal moneylenders.

Is there an overall limit on the total charges a legal moneylender can charge a borrower?

Yes, the total charges including interest, late interest, loan admin fee and late fees cannot be more than the amount that’s equal to the loan principal. This rule applies to all licensed moneylenders in Singapore, not just 1 – Money.

What’s the average moneylender loan sum that 1 - Money’s customers borrow?

It depends. We offer legal loans ranging from $300 to $100,000.

What’s the maximum sum I can borrow from a licensed moneylender?

The maximum sum you can borrow from a licensed moneylender is 6x your monthly salary, if you earn $20,000 or more annually. This is true no matter if you are a Singapore Citizen, Permanent Resident or foreigner who’s working and living here.

Do licensed moneylenders provide cash or PayNow loan disbursement?

As a trusted and quick legal moneylender, we’re happy to provide both cash and PayNow loan disbursements. Simply let us know your preference!

What are the modes of repayment for licensed moneylenders?

We can’t speak for other legal moneylenders in Singapore, but 1 – Money is a licensed moneylender in Singapore that prioritises your convenience. It’s precisely the reason why we offer a number of repayment methods, including GIRO payments, bank transfers, and cash payments at our office.

Do reliable licensed moneylenders operate fully online?

Reliable licensed moneylenders in Singapore do not operate fully online, even though many of them allow you to apply for moneylender loans on their websites at any time you wish.

Why must my licensed moneylender meet me at their office?

Your licensed moneylender must meet you in person in order to verify your identity and documents, do a complete but simple credit assessment, explain your loan contract and all loan terms in detail, and disburse your loan. All these can only be done at your moneylender’s registered place of business — nowhere else.

Is 1 - Money a 24-hour moneylender in Singapore?

As an online moneylender in Singapore, we accept loan applications 24/7 on our website. However, do note you’ll be required to visit our office for identity and document verification purposes, plus loan contract signing before you can get your cash.

How are 1 - Money’s services different from other licensed moneylenders?

Our loan company in Singapore stands out from the crowd because we prioritise flexibility, transparency, and top-notch customer care. Plus, our loan packages are carefully tailored to each customer’s individual needs.

Does 1 - Money personalise legal moneylender loan packages for customers?

Absolutely. We start by listening to and understanding your financial woes and requirements for the loan. From there, our experienced loan officers will assess your repayment capacity and personalise a loan package tailored to your needs. All moneylender loan solutions are unique, like you — we don’t believe in cookie-cutter solutions.

Do customers enjoy utmost privacy when getting moneylender loans with 1 - Money?

Yes, while our Bugis moneylender office is nestled in the heart of Singapore, our customers enjoy private rooms that afford unparalleled privacy and comfort during their visit to our office.

Why should I consider borrowing from licensed moneylenders in Singapore?

You should consider borrowing from licensed moneylenders if you’re in need of urgent cash but are unable to obtain a loan from the bank due to reasons such as low income or bad credit history.

How can I apply for a legal moneylender loan?

You can easily apply for a loan with us right on our website. Simply fill out the online application form and submit it, or opt to retrieve your information via Singpass Myinfo. The latter offers a seamless, time-saving process overall.

Do licensed moneylenders offer benefits for returning customers?

Not all licensed moneylenders have extra perks for their returning customers, but here at 1 – Money, we do! For example, the loan approval process will be significantly faster, and the chances of approval for a higher loan amount will be greatly improved, too.

What happens if a customer is unable to repay their licensed moneylender?

Being an understanding, professional moneylender in Singapore, we encourage our customers to reach out and inform us as soon as they can so we can work something out with them. We are happy to take the time to listen and understand their situation. From there, we’ll negotiate and craft a new restructured repayment plan that they are confident of repaying on schedule.

Keen to learn more about loans and licensed lenders in Singapore?

Visit our blog and read our educational articles — they’re free!